Why we're builing Fryd as a Purpose Company

Fryd is a social enterprise in steward ownership. We aim to protect our mission in the long term and prioritize societal impact over financial return. But what exactly does this mean? In this article, we explain what a Purpose Company is and why we have chosen this path.

The Startup Conflict

To understand the concept of the Purpose Economy, one needs to first understand how startup financing typically works: A young company develops an innovative product with great growth potential. Usually, one needs so-called venture capital for this, as upfront investment is required for product development and personnel build-up until the startup becomes profitable. Venture capital comes from investors who, in return, receive shares in the company. The goal is to increase the value of these shares to sell them at a significantly higher price to third parties after a few years. This share sale (exit) is also pursued by many founders themselves and is not inherently reprehensible. It rewards the high risk that investors and founders take in the early phase of a startup, for example, by forgoing salary.

However, focusing on an exit can lead to a conflict of interest: namely, between the goal of the investors - the lucrative sale of their company shares - and the actual purpose of the company. By this, we mean the mission with which the startup set out to solve a market problem while simultaneously creating jobs.

With increasing control by external interests, this sense of purpose risks being pushed further into the background, turning the company into a mere financial investment object. Instead of the mission, capital returns take center stage. Decisions may no longer be made based on what is best for the customers and the workforce in the long term, but on how the company value can be increased and monetized one day. This sale revenue then does not flow into the purpose, but mainly into the pockets of the owners.

Purpose Economy and Steward Ownership

Startups can protect themselves from this conflict of interest by legally anchoring the independence and value orientation of their company in its core: in the ownership structure. Companies in steward ownership commit to two principles:

(1) Self-determination - control through voting rights is exclusively with individuals who are actively involved in the company.

(2) Asset commitment - profits are a means to an end and not an end in themselves. They should primarily benefit the mission of the company.

In this TEDx talk, Armin Steuernagel, co-founder of the Purpose Foundation, explains the topic of steward ownership in an understandable and entertaining way:

The idea of the Purpose Economy is not new. Companies like Bosch or Zeiss implemented it over 100 years ago. There are various legal solutions to enact the two mentioned principles. In the current coalition agreement of the Federal Government, the creation of a new legal form 'GmbH with bound assets' is planned to simplify steward ownership legally and fiscally.

Our Mission at Fryd

We did not found the company Fryd with the intention of selling it one day. Our motivation is to help people with ecological vegetable cultivation, so that they can connect more closely with their food and consume more sustainably. Because we need to change the way we eat to preserve our planet for future generations. With this mission, we brought Fryd to life and built it up in the first years alongside our regular jobs and with our own money. We were supported by the German Federal Environmental Foundation and the Startup BW PreSeed program. At a certain point, a seed financing round became necessary because an app with over 50,000 users at the time required a whole team that takes care of the operation, support, and further development of the platform on a daily basis.

We implemented this financing round in 2021 according to the principles of steward ownership: Investors like Purpose Ventures did not receive company shares or voting rights. Instead, they gave us subordinated loans, which we want to repay over a period of ten years. The interest is dependent on our profit and capped at a maximum amount. In this way, we want to ensure that not too much money is taken out of the company, even in the event of success. The Purpose Foundation receives a veto right with 1% voting shares to ensure the principles of steward ownership. An exit is not sought, but rather the long-term establishment of a healthy company that is economically successful and balances the interests of all stakeholders: the environment, our customers, employees, and investors. We as the founding team can also no longer sell our shares to investors without the consent of the Purpose Foundation.

Our principles:

- We want to empower as many people as possible for ecological vegetable cultivation

- The entrepreneurial control over Fryd lies with people who are actively involved in the company

- Profits are not an end in themselves, but should benefit our mission

- We communicate honestly and transparently

- We treat employees and business partners fairly

- We act socially and ecologically sustainably

How To Support Us

With an annual Super Fryd membership, you help us cover our costs and pay our employees fairly. Only in this way can we offer and develop our service in the long term while remaining financially independent from external interests. Thanks to steward ownership, it is ensured that your money flows into our mission and that we handle it fairly.

Jens

Jens is one of the Fryd founders. He is convinced that entrepreneurship must be socially and ecologically sustainable. Privately, he gardens on the terrace and in community gardens in Stuttgart and Weiden.

Current Topics in the Community

This is what it looks like. I do this with all my plants.

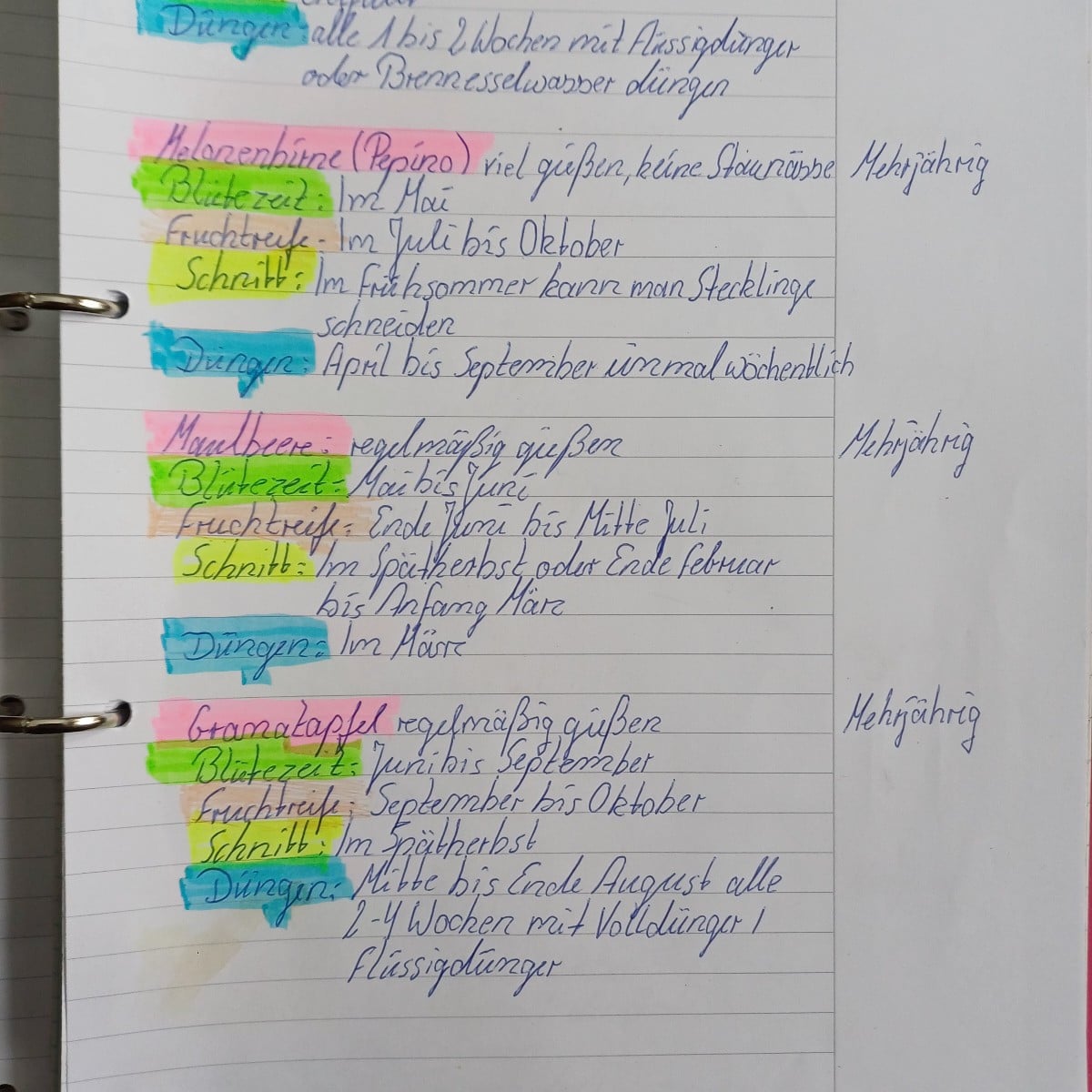

Last year, I created a garden or plant folder where I document all my plants. Plant (how to water it) Annual or perennial Flowering period Fruit ripening Pruning Fertilizing

Liked 1 times

My two banana plants are coming tomorrow. I'll be happy to send you a picture of them.

Show 1 answerPopular Articles

Overwintering Parsley: How to Do It Successfully

How to Grow Lettuce in Winter: Varieties, Sowing, Harvesting

Growing Sage Plant: Tips for Sowing and Harvesting

What Herbs Can Be Planted Together?

Create & Design a Permaculture Garden

Overwintering Plants: Tubs, Pots and Raised Beds

Pruning, Fertilizing & Propagating Currants: Care Tips

Pruning Raspberries: How to Do It

Vegetable Garden With Greenhouse: How to Use Greenhouse Effect

Winterizing Beds and the Garden: How to Do It